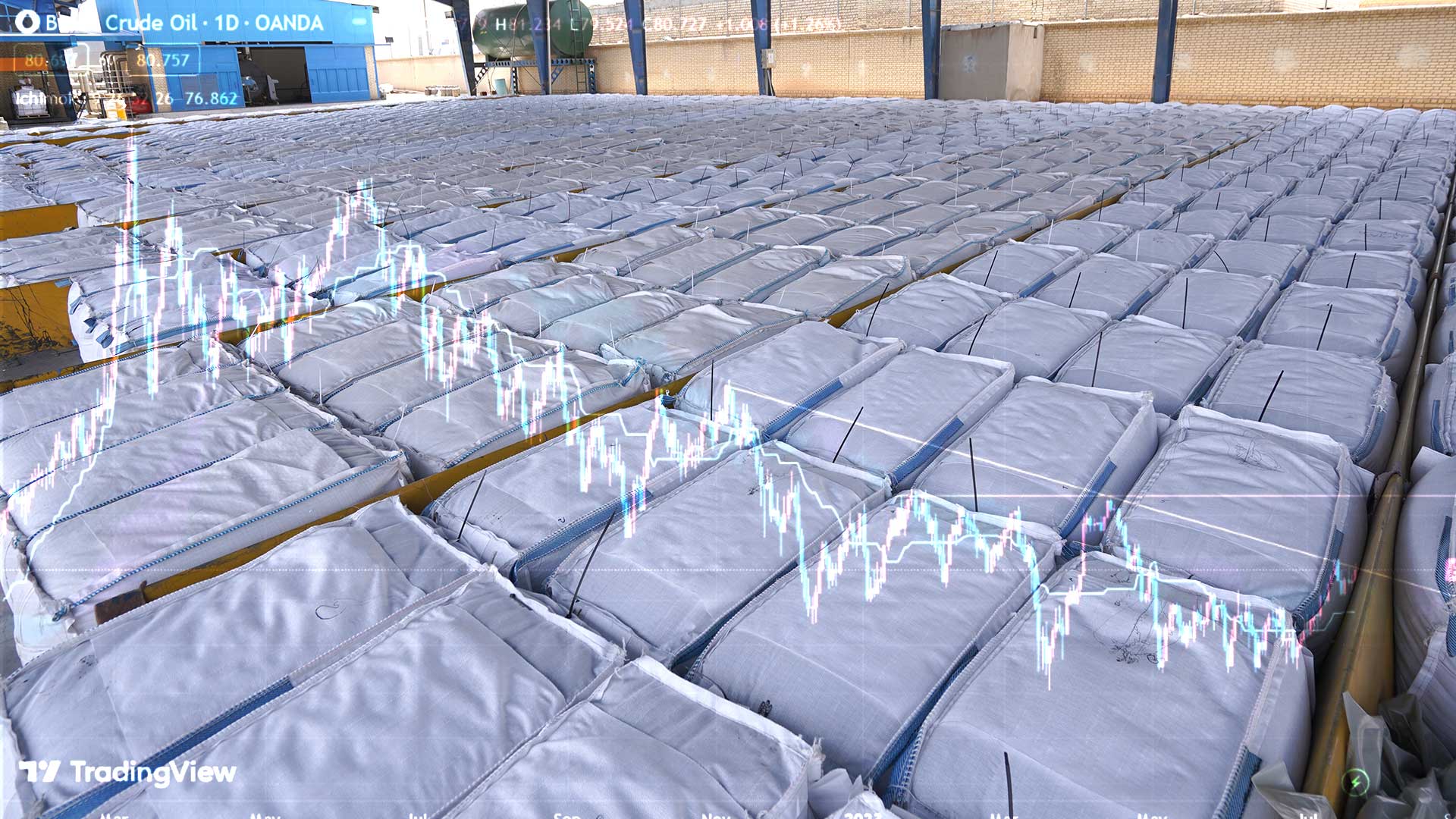

Oil prices moved exactly as predicted last week, with Brent oil initially falling to the $74 range before rallying with demand to reach $78.75.

As you see in the chart, the price has reached the resistance of the short-term downward trend. If it breaks through the resistance, the price will continue on its upward trend.

It is expected that oil prices will rise this week due to increased demand, with Brent crude reaching around $81.

Russian fuel exports have increased to an eight-month high

According to data from Vortexa compiled by Bloomberg, a surge in fuel oil exports has pushed Russia’s refined petroleum product shipments to the highest level in eight months in the four weeks leading up to December 31. The data shows that Russian oil product exports averaged almost 2.7 million barrels per day (bpd) in the mentioned period, which is a 6% increase compared to the four-week average of the week to December 24. In the week to December 24, the four-week average exports of fuels out of Russia stood at approximately 2.6 million bpd, an increase of around 157,000 bpd from the four-week average to December 17, marking the highest level in over seven months.

In December, Russia’s diesel and gasoil exports averaged around 1.17 million bpd, which is the highest monthly export level of 2023. Moscow eased diesel export restrictions and loadings from the Black Sea ports rebounded after some delays due to storms in November, thereby leading to the increase in exports. However, Russia had temporarily banned diesel shipments in late September and early October, as well as a nearly two-month-long ban on gasoline exports between the end of September and the middle of November, citing the need to stabilize domestic fuel prices amid soaring crude prices and a weak Russian ruble.

The recent surge in fuel exports and strong crude oil shipments has further muddled estimates of Russian oil supply and Moscow’s adherence to its pledged export cuts. Russia had vowed to reduce its oil exports by 300,000 bpd until the end of 2023. At the recent OPEC+ meeting held at the end of November, Russia announced it would deepen the export cut to 500,000 bpd in the first quarter of 2024. The cut this quarter will consist of reductions in exports of 300,000 bpd of crude and 200,000 bpd of refined products, with May and June 2023 being the reference export levels for the cut.

Rumays Specialists Group closely monitors market trends and invites you to stay up-to-date with oil market news and weekly oil technical analysis. Click here.