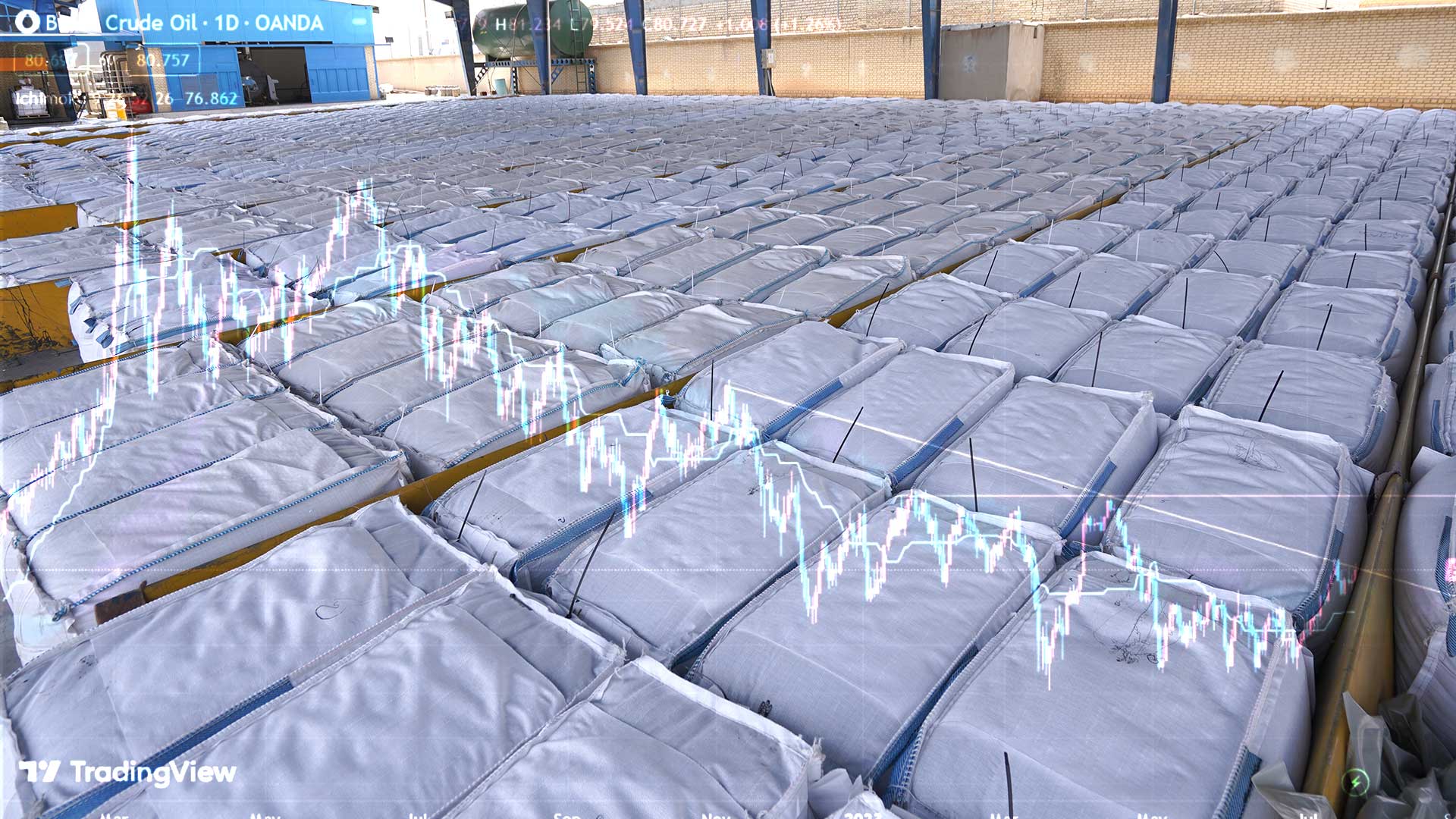

Based on last week’s forecast, oil could not break the short-term downward trend line and was trading down ahead of API data release as the year drew close to the end. It is expected that this downward trend will continue in the coming year, with Brent oil falling to the initial support of around $74.

Oil Inventories Rise Toward the End of 2023

According to The American Petroleum Institute (API), crude oil inventories in the United States rose by 1.837 million barrels for the week ending December 22. This is after recording a 939,000-barrel build in crude inventories in the previous week. So far this year, API data shows a net build in crude oil inventories in the United States of just over 21 million barrels.

In the current week, gasoline inventories fell by 480,000 barrels after an increase of 669,000 barrels in the previous week. As of last week, gasoline inventories are now 2% below the five-year average for this time of year.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) increased by 800,000 barrels. The inventories have now reached 353.3 million barrels, with total purchases for the SPR totaling more than 6 million barrels since the buyback program began under the Biden Administration.

Rumays Specialists Group closely monitors market trends and invites you to stay up-to-date with oil market news and weekly oil technical analysis. Click here.